What led you down the path of being a startup founder?

I started my first business in college, building the first academic department websites after the launch of Netscape 1.0. Although I spent many years on Wall Street, I had always intended to try and start a company eventually.

In the fall of 2021 I left my job at Morgan Stanley after 17 years and joined up with Jia Yng, my co-founder, to launch Cloudwall in NYC and Singapore.

What problem is Cloudwall solving?

In 2021, we saw institutional interest in crypto reach a tipping point. We witnessed a series of high-profile scandals in the crypto industry – from scams, to market manipulation, to hacking – causing significant losses for investors. These incidents exposed the lack of robust risk management solutions for institutional investors in the crypto market.

As a team with experience in traditional finance and risk management, we recognised the opportunity to bring established best practices and advanced systems to the crypto industry. We saw a gap in the market for an institutional-grade risk management solution and understood its significance.

We established Cloudwall’s U.S. entity in October 2021 and the Singapore entity around Christmas 2021. The company is now 12 people globally, a mix of engineers and quants building a sophisticated risk platform.

We anticipate that asset management will become fully tokenised, so we see significant growth potential for our platform in the future, allowing us to expand from the early crypto-native innovators to established asset managers.

Why did you choose Australia as your next market? What makes it a good fit?

Australia has an open and forward-looking regulatory environment. Our market entry order is informed by regulatory trajectory and level of crypto engagement, especially active asset management. With a high level of retail crypto ownership, a mature crypto-native asset management industry, and a thriving Web3 startup ecosystem, Australia provides a promising growth opportunity for our global ambitions.

The Australian Government has demonstrated positive support for responsible innovation and consumer protection in the digital assets space, shown by the Treasury's recent release of a Consultation Paper outlining a proposed "token mapping" exercise to define appropriate obligations and operational standards.

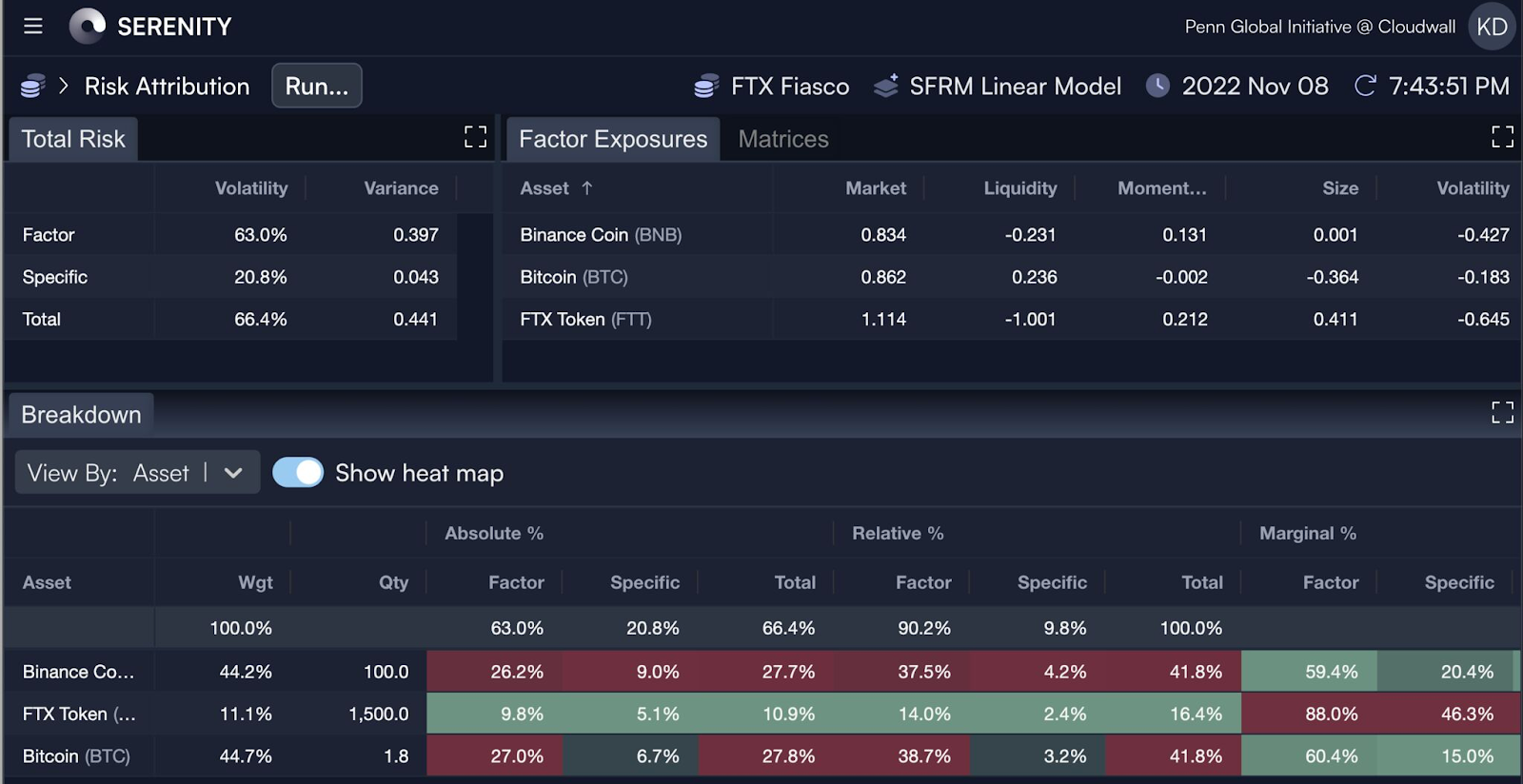

Serenity, Cloudwall’s flagship product, is a cloud-based platform enabling clients to run risk models and generate scenario assessments of their portfolios. Given the homogeneous international nature of our targeted potential clients, Serenity is a great fit for Australia’s growing market.

What can your company offer to Australia?

At Cloudwall, we understand that effective risk management is paramount for investors. As their exposure to digital assets increases, it becomes essential to have an institutional-grade risk management tool that can help them systematise their view of these assets.

With Serenity, investors can confidently manage their digital asset portfolio, even in the most volatile markets.

As part of our expansion plan, we are exploring the possibility of sourcing talent from the rich talent market in Australia to strengthen our core engineering and sales teams at Cloudwall.

What’s your ask? What can our reader do to help you succeed?

You can follow Cloudwall on LinkedIn, reach out for a demo, or join us for our events.

The GIA Singapore-Australia Market Accelerator is 6-month intensive program to help Singaporean tech companies expand into Australia, in partnership with Enterprise Singapore. Learn more about the program here.